Exclusive Guide on How to Calculate Gratuity in UAE

As an employee in UAE, understanding how to calculate your end-of-service gratuity is crucial for financial planning. This article will guide you through the process, explaining the formula, factors involved, and examples to help you estimate your gratuity accurately. By following this article you can easily understand How to Calculate Gratuity in UAE

What Factors Influence the Amount of Gratuity in Dubai?

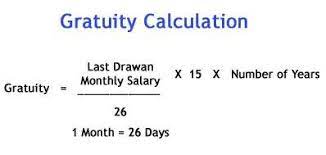

Gratuity Calculation Formula

The formula for calculating gratuity in Dubai differs based on the type of contract

Limited Contracts

For employees on limited contracts, the gratuity is calculated as follows: - For the first five years of service: 21 days' salary for each year. - For each additional year beyond the first five: 30 days' salary for each year.

The formula can be expressed as:

$$ ext{Gratuity} = left( rac{21 imes ext{Basic Salary} imes ext{Years of Service}}{30} ight) $$Termination for Cause: Employees terminated for cause under Article 120 of the UAE Labor Law may not be eligible for gratuity. Part-Time Employment: Gratuity is typically calculated based on full-time employment. If an employee has worked part-time, it may affect their total years of service.

Conclusion

Calculating gratuity in Dubai involves understanding the formula, factors, and exceptions. By considering the employee's basic salary, duration of service, and contract type, you can estimate your end-of-service benefits accurately. However, it's important to note that gratuity calculators provide estimates and are not legally binding. For official calculations, consult with your employer or the Ministry of Human Resources and Emiratisation.